2.1 The Circuit of Industrial Capital.

We begin by outlining the basic mechanisms of the circulation process. The economic base, or real foundation, comprises the twin elements of relations and forces of production. The former represents the social circumstances which relate individuals to each other with regard to the production and appropriation of surplus-value ; the latter represents the rode of economic or material life and organisation, the level of technology, nature, human qualities, etc., with which the relations of production must operate. Any advanced capitalist society is one whose economic base, by definition, has experienced considerable accumulation and division-of-labour.

To analyse such accumulation, we use the circuit model which brings out the important distinctions between forces and relations, between production and distribution/exchange, and between the production process and circulation process. This is one of Marx's most brilliant simplifications - the basic idea of the circuit is one of reproduction, not production. It is used to analyse a situation where start becomes finish to start again on an expanded scale (Le. as it is across the entire Monetary base of the (Mp). Hence, the capitalist advances fixed and circulating ("working") capital to purchase means of" production and the labour-power of the working class to start the circuit. He receives at the end an expanded mass of money capital, now including his net profit which he (or his bank) could temporarily hoard or immediately reintroduce into the next turnover cycle. Capital in changing its form over the cycle cannot be given any unambiguous (algebraic) definition; capital in Marx's sense must always be related to the reproduction of the underlying capitalist relations of production, wage-labour and capital, as they relate to the turnover circuit. "Capital is not a simple relation, but a process, in whose various moments it is always capital" (Grundrisse, 258, also 221-370 for Marx's definition of capital).

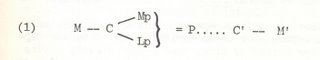

Within the CMP, the circuit of reproduction assumes the form: M - C - M'. Fully expanded this becomes :

where M is money capital, C is commodity, i.e. marketed production, Lp is labour-power (also a commodity), Mp is means of production, and P is productive capital. The primed values represent in general greater magnitudes than the unprimed ones and also later historical stages of a circuit or part of a later circuit. M’ – M = m’ or gross profit (see Macrae, The Neglect).

As expressed, this circuit represents the essentials of the underlying relations of production: labour-power as a commodity exchanged for M and organised with means of production by an industrial capitalist. It may also be used to assess the level of development of the productive forces since these will be reflected in the speed (time) of the turnover of capital i.e. the time elapsing between M and M'. We see, also the roles played in this process by a) the speeding up of the production process - continuous shift work, electronic technology with instant calculations, better product flow and b) the speeding-up of the circulation process - use of marketing, advertising, hire purchase agreements etc. to telescope the time of circulation. All these agents contribute therefore to the more efficient reproduction of capital (see discussion of productive and unproductive labour in 3.6 below).

2.2 Extensions and Generalisations

The above circuit (1) may be extended to assist in understanding certain key parameters of the system, for example the rate of profit – “The motive power of capitalist production” (Marx, Capital, Vol. III, 259). We shall also generalise it to account for interlocking circuits, both within social formations, and between them (internationalisation, Sect. 2.5) something of fundamental importance for our subsequent analysis of the N.Z. social formation.

According to Marx, it is during the production process (or during the production phase of the circuit indicated by the series of dots in (1) above) the surplus-value is created, although it does not take on a monetary form until it has been realised as part of gross sales revenue or M'. It is in the form of monetary profit that surplus-value therefore makes its appearance in the CMP. Accepting the formal identity between the mass of surplus-value and the mass of profit as Marx defines it, the annual rate of profit is defined as r (A).

(Note: this important distinction must be made more strongly in this current era of costing of “profits” for reasons of tax evasion, thus reducing the significance of ‘declared profits’ as a measure of r (A))

The rate is a relation between a flow magnitude and a stock magnitude. It represents the gross return over total capital advanced by the capitalist, over a particular period of time, that period thereby giving the rate its time dimension. From (2) it follows that r (A) is directly related to the mass of the surplus-value created, and this in turn, is a function of several variables, the most important being:

(a) The rate of surplus-value - itself a function of the level of development of the productive forces

(b) The number and quality of productive workers employed

(c) The number of effective 'turnovers' of production that can be completed in a year which in its turn is dependent on a range of factors e.g. levels of demand, sales, administrative efficiency, state intervention, together with the development of the credit system, all of which speed-up the circulation process; and factors such as mechanisation, rationalisation etc. which speed-up the production process itself.

Our analysis has pointed to the functions of sales agents, credit terns, managerial education and so on in speeding-up turnover. These items may be added to Marx's general list of counter-tendencies operating to overcome the falling rate of profit (Capital, Vol. Ill, 232-240). They all act ultimately on the rate of turnover and hence, the rate of profit, either by helping to economize the amount of capital to be advanced, or by spreading fixed expenses over more production runs. Distinguishing fixed from circulating capital is also important for questions of pricing, employment and distribution (Macrae, The Neglect).

(Note: It is important to know how our analysis of reproduction is distinct from most existing Marxist analyses which stress a static approach to the economic base. Such approaches are dominated by questions such as “who gets more or less surplus-value”, or “what groups represent ‘drains’ on surplus-value” often leading to a discussion at the level of distribution rather than one based on a dynamic value analysis.)

Using the circuit model is it possible to get from an expression of an annual rate of profit (2), to a general rate of profit for any given social formation? Such a vexed question involves a consideration of the total social capital as composed of individual capitals with individual rates of profit, each circuit interlocking with others to reproduce the total social capital. Now a circuit of capital can interlock with another in a number of different ways, depending on the particular form which it takes on. One of the most important interlocks is that between the circuit of finance capital, put at the disposal of industrialists; this is the classical context of the discussion of imperialism (See 2.6 below).

According to Marx's analysis in Capital Vol. III, the general rate of profit is formed by re-allocating total surplus-value across departments so as to equalise the rate of profit (as defined in (2) above) in each. But, if we view surplus-value as a flow deriving from the continuous movement of production, as in the circuit model, we cannot undertake any transformation as per Vol. III unless we assure a particular historical structure and phasing of interlocking circuits. If surplus-value is an irregular flow, it is not a stock that can be parcelled out into its ‘aliquot’ parts. Consequently it is doubtful whether any meaningful general rate of profit can be measured for a given social formation.

2.3 Money and Credit

Use of the interlocking circuit model clearly presupposes an advanced use of money in various forms. Money is the universal medium of exchange by which the circuits can be renewed. In this context money plays the role of a means of commodity circulation, although the Marxist theory of money encompasses other vital functions as well - in particular a measure of value and as an object of specific demand itself, even when it takes the form of inconvertible paper (De Brunhoff, p. xv). Indeed, the acceptance of money as a medium of circulation presupposes its establishment as the measure of value. It would seem, however, that with the development of the credit system, the function of money as a means of circulation declines relative to that as a unit of account, or measure of value, or obligation of debtor to creditor; here lies a major reason for recurring monetary crises, namely the 'liquidity crises' that occur when debts falling due cannot be met. While in normal times, the credit mechanism works to cover such gaps and enables the entire interlocking system to continue, at times of crisis this breaks down, loans are recalled, disruptions of production occur, and so on.

We can see then that there are fundamental interconnections between the credit system and the various interlocking production circuits. In some cases, the only interlock between branches of production may be, not by the exchange of commodities, but through the credit system itself, recycling ‘fallow’ capital from one otherwise independent branch to another. In this respect we see that the main functions of bank credit may be summarised as follows:

(a) Economising the absolute amount of capital to be advanced by the industrial capitalist, at the expense of course of interest payments drawn from the mass of surplus-value the industrial capitalist receives - i.e. a deduction from his gross profit.

(b) Speeding-up turnover by substituting for an inability to pay (commercial bills etc) and boosting low levels of purchasing power (hire purchase etc).

(c) Transferring balances of firms and individuals of one branch to make than work in other branches of production affecting (a) and (b) above, and raising the share of interest in surplus-value. These transfers of M raise the velocity of the circulation of money and thereby the possibility of an increase in the rate of accumulation. This is because the increased velocity of the circulation of money facilitated by the credit system is of itself insufficient to increase the rate of accumulation. It presupposes conditions such as the willingness of capitalists to invest, stocks of commodities, balance of payments etc. It may stimulate rapid inflation and contradict the basic aim of increasing capital accumulation, a point we take up below.

The importance of these credit functions in relation to the rate of profit has been shown by recent research. In their study of the declining profitability of advanced industrial capitalism, 1955-1975, Loiseau et. al. are struck by the very rapid growth in indebtedness of industrial firms to the banks over this period. The authors regard this important trend as both a countertendency to falling rates of profit, as well as a warning of the impossibility of repeated recourse to borrowing of this nature (from the credit system) to overcome the long- term tendency of continued decline in profitability .

Money itself has no price, rather a rate of exchange which ties money to socially necessary labour time, thereby expressing the function of money as a measure of value (De Brunhoff, 27). Inflation results in the depreciation of this rate of exchange between money and value. This is immediately reflected at the level of distribution as the depreciation of the holdings of money creditors, who are now repaid the equivalent of less value than they had originally advanced (depending of course on the exact terms of interest and repayment) and favours debtors who must pay a lesser equivalent in terms of value. Whilst much capital that exists today is fictitious capital (i.e. capital which does not enter directly into the productive circuit and therefore plays no direct part in the augmenting of capital, but which nonetheless exists in the form of a monetary claim on total surplus-value, e. g. interest on the national debt (Marx, Capital, Vol. Ill, 465), this mass of fictitious capital is clearly increasing with inflation and its growing claim on total surplus-value is not fictitious. There comes a stage therefore, when monetary phenomena (inflation, balance of payments, interest and exchange rates etc.) will hinder the reproduction process. Whenever monetary phenomena, in the guise of the credit system, interpenetrate the reproduction circuit, as they do to such an overwhelming extent in contemporary capitalism, the potential for crisis is so much more greatly increased. And as the state is drawn into the management of reproduction, any measures affecting money, such as credit policy, expenditures or other policies adopted by governments, because they affect the "universal medium", must therefore percolate throughout the entire system.

2.4 The State and Reproduction

The capitalist state functions to reproduce the CMP at three levels - the political/legal, the ideological and the economic.

(a) Political/Legal. By this we mean the establishment by force of capitalist social relations - the separation of the direct producers from the means of subsistence and production, both in Europe, and the lands subsequently penetrated by the CMP. This function therefore is historically prior to the establishment of the CMP and its internationalisation (See Marx on "Primitive Accumulation" Capital, V. I 667-724), but remains a necessary condition of reproduction of total social capital on a world scale today as imperialism (2.6 below). The legal aspect of the states function is to legitimate the possession of private property, i.e. the conversion of means of production into alienable commodities including that of labour-power (e. g. the laws governing maximum wages and restricting strike action etc). This function of the state corresponds most directly to the bourgeois view of the state as an institution which has a monopoly of the use of force. Althusser refers to this area of state activity which contains the “Government, the Administration, the Army, the Police, the Courts, the Prisons etc” as the Repressive State Apparatus (Lenin, 136).

(b) Ideological. This function of the state is concerned with the reproduction of capitalist ideology. It extends the commodity fetishism of the marketplace into the realm of politics and culture by means of the Ideological State Apparatuses -educational, family, legal, political (including parties), trade-unions, communications, the arts etc. (Lenin, 137). The reproduction of ideology is basic to the reproduction of capitalist social relations since it constitutes bourgeois' subjects'- i.e. character structure of bourgeois individuals. Political, Legal and Ideological functions combine to give us the ‘form’ or ‘appearance’ of the capitalist state including Social Democracy and fascism. The particular combination of any given form reflects the ‘relative autonomy’ of the state in performing its basic economic function (Bedggood, The Limits, cf. Poulantzas, Classes, 17-35).

(c) Economic. This function presupposes some combination of (a) and (b), i. e. some balance of force and ideology, in establishing the conditions of production. At this level the state intervenes in the circuit of capital to operate countertendencies to the falling rate of profit and to reproduce both national and international capital (see 2.5) These interventions can be understood in terms of the points at which they affect the circuit of industrial capital as expressed in (1) above.

M - Mp - The state advances capital in the form of an infrastructure (public works, railways, ports etc), or in the form of loo interest loans or outright grants. Thus the absolute amount of capital advanced by capitalists is reduced and the organic composition of capital held down, both counteracting the falling rate of profit.

M – Lp - This is a state subsidy which cheapens the reproduction costs of labour-power to the capitalist. It takes the form of a subsidy on wage-goods (food, mortgages, state rentals, public transport etc) or wage-transfers (the provision of health, education and social services). The ‘cheapening’ of these elements in the value of labour-power is paid for by means of tax revenue drawn ultimately from surplus-value but immediately from wage and salary earners, transferring this cost from the capitalist via the state to the working-class.

P . . . C' - As well as subsidies to productive capital, the state intervenes in the production process itself. Intervention in the private circuit consists largely in the applications of research and development to increasing productivity and in speeding up the production process itself. Since competition generates a drive to improve productivity, state involvement in subsidising the advancement of technology becomes increasingly important. Direct intervention in production takes the form of the nationalisation of particular branches which require exceptionally large capital outlays (energy, transport etc) or which are too risky or unprofitable. In this way the state subsidises the losses involved in high-risk or low profit areas, allowing the goods and services produced to enter into the circuit of capital at less than 'economic' prices. In so doing it makes possible the concentration and centralisation of capital at rising levels of organic composition, developing the forces of production and intensifying the contradiction between private ownership of the means of production and the increasing socialisation of the forces of production.

An important area of state intervention in the circuit is between M' at the end of one turnover and the re-investment of M' as C' at the beginning of another. This concerns the state's policies in facilitating the mass of productive capital and the speed with which it circulates, since productive capital alone (combined with Lp and Mp) makes the production of surplus-value possible. Of course the purpose of all forms of state intervention is to counteract the falling rate of profit and by doing so, to make the re-investment of M' more attractive to the capitalist than consumption, hoarding or speculation. Nonetheless, to the extent it can influence the decisions of capitalists or their agents concerning the use of M', the state plays an important role in the reproduction of capital. The main instruments it uses to control the direction and speed of ‘capital formation’ are those which help to reduce the cost of credit. However, since the operations of the government itself affect this cost by influencing the amount of credit available and the amount demanded, then the analysis of state intervention at this point in the circuit is tied up with the circumstances of overall fiscal policy as reflected in the state budget.

By means of various institutional arrangements, the state establishes a mechanism of continual credit creation and credit rotation which can be altered to suit the particular needs of capital. Since the state bank has the power to create credit, it can theoretically create unlimited credit to cheapen its cost and encourage the efficient re-investment of M'. In practice however, it cannot do so beyond certain limits without causing hyperinflation and with it that consequence it seeks to avert, namely an investors' strike. It has therefore to rely upon a policy of combining some credit creation together with the rotation and control of credit within the private sector, referred to commonly as the ‘stop-go’ counter-cyclical policy.

The credit policy of the state's bank has therefore two major goals:

i) to manage the state's own credit needs, and ii), to provide for the credit needs of the business sector in general. For instance, directives to the trading banks to hold more government stock would be made if the state's budget was in heavy deficit, whilst the private sector has a surplus of M'. Selling government securities would have the same impact in principle, raising the cost of credit (the rate of interest) by reducing the supply available to the business sector. The reverse would be the case following a policy of deliberate expansion of the supply of credit. In general, the state's credit policies work to flatten the business cycle by means of its counter-cyclical ‘stop-go’ controls. It will also attempt to prevent the non-productive use of M' in hoarding or speculation as prices and interest rates rise by means of selective incentives. The logical development of such policy is of course for the state to assert increasingly tight control over capital formation to ensure its recirculation as productive capital. In doing so however, it cannot escape the limits of the credit system as a means of overcoming the rise of inflation, the depreciation of commodity prices, and finally, crisis (Bullock and Yaffe, Inflation, 26).

In concluding this section it should be stressed that while the state’s economic interventions are designed to arrest the falling rate of profit in the short term, this merely transfers the tendency from the market onto the state itself in the form of ‘fiscal crisis’. That is to say, the increased costs of subsidising capital become steadily less productive of total surplus-value. The state runs up mounting expenditures wyich tend to outrun its ability to increase its sources of revenue. And as this deficit cannot be met simply by ‘printing money’ beyond a certain point without fuelling inflation, or by increasing taxation of surplus-value going to the capitalist in the form of profit, rent or interest, it must be raised by increasing the rate of taxation of both the productive and unproductive working class. This puts the state in the position of having to expose its functions on behalf of the capitalist class as it becomes difficult to reconcile its attack on workers living standards with a ‘neutral’ non-class ideological status (Bedggood, State Capitalism). The result is that class struggle within the state apparatuses becomes generalised across economic, political and ideological levels, placing limits upon the states ability to resolve the basic contradictions short of the social expropriation of the means of production.

2.5 Internationalisation

So far we have considered the process of reproduction in abstract terms without reference to particular social formations. In this section we propose to relate reproduction specifically to the internationalisation of capital. As we have pointed out, the development of capitalism in New Zealand is, by definition, related to the development of the CMP on a world scale and can only be properly conceived at that level. What we shall do here is to apply the interlocking circuit approach to the problem of internationalisation as it affects the development of capitalism in New Zealand. In the light of this discussion we shall then examine the applicability of the traditional theories of imperialism to this problem.

We start with the circuit of an industrial capital (M1) which can be schematised (after (1) above) as follows:

In this example, industrial capital in branch 1 takes on at least three different forms at various phases (Marx, Capital, Vol 11 (chaps 1-3l Palloix, Self Expansion, 19) namely

1. a commodity capital circuit C1- M'1 – C'1

2. a productive capital circuit P1 – M'1 - P'1

3. a money capital circuit M' – C'1 - M'1

Each of these has to be reproduced in order for self-expansion to occur. In addition various other framents of capital are required at particular stages. These are:

· merchant capital to realise linkages marked -

· bank capital to achieve adequate levels of M

· realisation capital to facilitate the entire circuit by promotional advertising etc of commodities for sale.

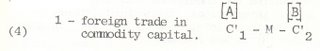

Note that we have surrounded the whole process by a bracket to indicate that the entire interlocking process bakes place within a given social formation designated by [A]. Now we proceed to extend this to an international context by distinguishing different ‘brackets’ i.e. distinguishing the different (geographical) locations or sites of various components of the whole self-expansion process.

As Palloix puts it:

The process of internationalisation in relation to the self-expansion of capital does not refer simply to the extension of the process of self-expansion beyond national boundaries . . .The internationalisation process is not a reality external to capital, a reflection, a result, (a spatial overflowing, an intersecting of foreign capitals) . . .(it) is a result of the world-wide universality of the CMP . . .internationalisation manifests itself both as an expression of: the national division (into social formations); the universality of the CMP (the generalisation of wage-labour); and the law of uneven development. It takes this form in order to assure the continual increase of the rate of surplus-value on the basis of the fusion of M-Lp and M- Mp within the process of production. The internationalisation of capital and the working of the national economy are not antagonistic, not two alternative realities, but are two phenomena which constantly mirror each other, amplifying each other in their historic development because they are both shaped and moulded by capital (ibid: 23)

We define internationalisation here as the process of ‘unification’ of different social formations by means of capital in its various forms and fragments for the purpose of its own self-expansion. Given the various forms and fragments of capital mentioned above, the patterns of internationalisation as it affects different social formations will be extremely variable. The best know cases would be:

In addition to industrial capital, merchant and bank capital will be involved in the process. The ‘hegemonic’ industrial capital circuit M-C-M will absorb these fractions in its movement. Thus local capital will normally be used to provide commodities auxiliary to the main production process, financial services, or wage-goods to workers employed by foreign capital. Rarely does the dominated social formation provide large amounts of capital in the form of instrument of labour embodying advanced technology (machinery, electronics etc), this being reserved for sale by other branches of capital at the centre. A typical interlock with the local social formation is the absorption of national money capital for advance to the industrial circuit, and it is in this that local finance capital plays a key role. These are some of the mechanisms by which' hegemonic' capital self-expands through the uneven development of the social formations drawn into the internationalisation process.

Having stated the problem in its most abstract and generalised way, we now proceed to its application to the New Zealand formation. In the first place, since the CMP came up against a pre-capitalist and nonmonetised mode the form of Maori society, the existing formation had to 'adapt' to the needs of capital. This had to involve the introduction of money forms by means of the attraction of native labour into construction work, and the dispossession of the land - in short the undermining of the system of production for use-value in Maori society with production for exchange with the CMP. The most significant form of commodity exchange implanted in N.Z. was that of the white-settler production of commodities indirectly related to the circuit of industrial capitalism. By this we mean the production of wage-goods for reproducing labour-power in Britain, which in its turn was then directly involved in the production of surplus-value in Britain. There would not be, for some time, a locally established branch of production into which British industrial capital could interlock. The other side of the semi-colonial commodity production was therefore the requirement for money, for capital, mainly freed-up rentier capital from the U.K. which could be used to establish the conditions enabling the new colony to play a role in the international division-of-labour. Schematically we may describe these interlocks as follows. In this diagram [A] is the U.K. and [B] is New Zealand.

We have distinguished here between capital advanced by the enterprise (M11 or M21) in each social formation, and that advanced by agents, namely the rentier in the U.K. (M12) and indirectly, via the state, In New Zealand (M22). We ignore the private rentier capital invested in New Zealand and the export of industrial commodities from the U.K. to N.Z. which in our view were relatively minor interlocks in the initial period (see 3.5). Key interlocks are expressed by the arrows. The rentier interest on M12 in the U.K. is m12 = M'12 – M12. The interest on M22 (the N.Z. public debt) is m'22 = -M'22 – M22. The basic function of the new colony therefore was to expand U.K. industrial capitalism by cheapening the reproduction costs of labour-power, and providing a secure outlet for the investment of rentier capital. Both operated as counters to the falling rate of profit.

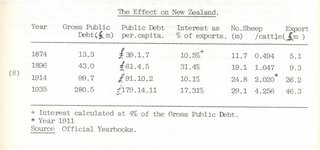

Once these interlocks had been established their impact on the two social formations was quite dramatic. During the first third of the 19th century England imported only 2.5% of its foodstuffs. In 1912 it imported mainly from Australia and New Zealand about 50% of its meat, 70% of its butter and 50% of its cheese (Harms, 1912: 176). The consequences for New Zealand's economy are summarised below:

Once established this pattern of internationalisation of the circuit of commodity capital has never ceased to be of prime importance to the New Zealand social formation. However, the modern period (Post W. W. II) exhibits a far more diversified and evolved pattern of inter-locking than that illustrated above. The contemporary pattern of circuit interdependence is outlined in greater detail below (see Section 3.). We shall limit ourselves to an analysis of the main forms of dependence in abstract terms. The major new development in the modern period has been the establishment of a range of production processes in New Zealand organised along industrial capitalist lines, under the domination of foreign capital. Foreign capital dominates directly - by direct or partial ownership in conjunction with a fragment of national capital of these branches. Or else it dominates, indirectly, by provision of the range of modern instruments, materials, patents, licenses, agencies, managerial expertise etc. essential to the reproduction of capital in New Zealand. - all of which are supplied by 'hegemonic' capital. In other words, MA (foreign capital), in various forms, constantly traverses the reproduction of local capital (MB) which in turn functions to reproduce the former (Palloix, Appendix, 21). The following are a few examples of this new pattern of dependence. In all cases, A refers to "abroad", B to the local N.Z. social formation. We also break down Mp into instruments and materials of labour (e.g. machinery and oil), symbolised by IL and ML respectively.

Case A - a joint venture producing previously imported articles of consumption or instrument of labour

In the extreme case of A (colour TV’s for instance) no MA is advanced in [B], but m'A is drawn off in the form of royalties etc. arising out of the assembly and sale of TV’s in NZ from 'kitset' packs supplied by the licensing company. Local capitalists are happy at the monopoly profits provided (m'B) under the protection of rigorous state enforced import controls on foreign competitors.

Case B - The provision of materials of labour for a MNC (eg Comalco)

In this case, Cornalco gets cheap auxiliary materials of labour (electricity C’B ) to smelt imported bauxite ore, which is subsequently re-exported (C’A). Although the production process is located in New Zealand (PB), this signifies few linkages apart from some local employment, (LpB) and, because of transfer pricing, little chance to claw back any declared profit (m’A'). In effect the huge state investment involved in MB (supplying the electricity) and the low price of its sale means that the New Zealand working-class subsidises the profits of the huge MNC, Cornalco.

Case C - Foreign control of processing of smallholder production (eg meat)

Here the foreign company sells the processed meat (C') to its overseas subsidiaries at inflated overseas (EEC) prices. Smallholders provide the livestock (ML) at low costs and are vulnerable to developments all down the line of processing, transporting, marketing etc.

Case D - Provision of an advanced transport facility (eg Air New Zealand)

I

n this case, heavy overseas costs for importing IL and ML from [A] (fuel, aircraft) are met by state guaranteed overseas borrowing (MA). Revenues to return these advances, together with interest, are earned by charging New Zealand and foreign users high monopoly tariffs for travel (the commodity sold) on protected South Pacific routes [C'A/B].'

These cases illustrate the degree of penetration of foreign capital in its commodity, money and productive forms into the contemporary social formation. The examples underestimate the degree of dependence on foreign capital since they ignore for instance, the indirect links to foreign capital through locally provided materials of labour e.g. imported oil to provide electricity (MLB) in the case of Comalco and other firms. Nor does the degree to which the local state makes concessions such as export incentives, state regulation of wages etc. to foreign investment to make the conditions for production as attractive as possible, show up in these examples. Moreover, the links with overseas banks, finance, merchant and insurance companies, all of which can be related to the above circuits, have not been isolated.

All these links act to manage the flows of commodity production and thereby also to transfer as much of the surplus-value as possible from the direct producers to the various fractions of the capitalist class both in New Zealand and overseas.

2.6 A Note on Imperialism

So far we have limited our discussion of the main interlocks affecting the N.Z. social formation to the analysis of the internationalisation process. We have made no reference to the political and ideological context in which this interlocking of circuits occurs. We now want to trace the connection between the internationalisation of capital and the rise of imperialism in order to determine the role of the semi-colonial state in this process.

According to Palloix, imperialism differs from internationalisation, being the manifestation at the political level of the role of the core capitalist states in linking-up the CMP in various social formations on a world scale. If we conceive of internationalisation as the ‘unification’ of social formations by the CMP, then imperialism is the political form taken by this unification. The core states’ dominance over peripheral and semi-peripheral states ranges from direct rule to formal independence, demonstrating the imperial states' ‘relative autonomy’ within the limits set by the particular historic circumstances of internationalisation. Usually the initial interlocks with pre-capitalist social formations will he established by force, but the development of these interlocks may be managed by ‘self-governing’ or ‘independent’ client states. Imperialism, so defined therefore, spans the whole epoch of internationalisation from the 16th century to the present day. While we should be careful to distinguish between successive phases of imperialism, an adequate theory of imperialism must be able to account for the co-existence of internationalisation and imperialism over the whole epoch (Murray, Value, part 2).

According to our definition imperialism refers to the role of the core state in serving the needs of capital accumulation by territorial expansion. While Marx noted the importance of the state as “a powerful lever of capital accumulation” in the mercantilist phase (Capital, V. I, 706) he appeared to limit its role to one analogous to ‘primitive accumulation’ in the period of free trade (i.e. the bombardment of new markets into submission in India and China, and in opening-up the lands of white-settlement). In the chapter on the ‘Modern Theory of Colonisation’ (Capital, V. I Chap. 33), Marx quotes approvingly the Wakefield analysis of systematic colonisation. A working-class could be created according to this plan even when land was abundant, as in the colonies proper such as Australia (he does not mention N.Z.) by means of a ‘sufficient price’ policy operated by the state. The resulting fund would be used to manage immigration and keep the labour market full for the capitalist. But later on in this chapter Marx reflects on the limited usefulness of this particular analysis in the light of events in North America where other factors such as the civil war, the rise of the national debt, in brief “the most rapid centralisation of capital” (Capital, Vol 1 724) were more important in creating the conditions for capitalist development than any Wakefield type of scheme.

Despite these observations, and the brilliance of Marx's vision of the future development of the Pacific Basin (On Revolutions, 392), he and Engels avoided any serious consideration of the long-term consequences of the introduction of the CMP into the Australasian colonies. They preferred to believe that the abundance of 'free' land would remain a permanent barrier to capitalist production on any large scale, and that as markets for British goods they would be rapidly ‘glutted’ and incapable of preventing the coming crisis in Britain (Mayer, Marx, 97). In other words the element of wishful thinking prevented Marx and Engels from developing their theory of ‘foreign trade’ to allow for the new financial interlocks between the self-governing colonies and the Imperial state. They failed to appreciate therefore the important role of the semi-colonial state as a ‘powerful lever of capital accumulation’ not only in the colonies but in Britain.

Of course it can always be argued in their defense that the great increase in British capital exports to the self-governing territories did not take place until after 1880, too late for Marx and Engels to be aware of their significance (Barratt-Brown, Economics, 189). Today, with the benefit of hindsight, we can see that the interlocks established between Britain and the colonies proper in the first half of the nineteenth century were characterised by a form of imperialism in which the initial use of imperial state force to implant the CMP was followed by a rapid transition to self-government by the settlers. This form of imperial core/periphery connection was entirely consistent with the nature of the interlocks established (see (7) above).

If Marx and Engels had some excuse for underestimating the rise of capitalism in the semi-colonies, Lenin and Bukharin did not. Though they showed that the uneven development of the colonies and semi-colonies was the consequence of the centralisation of capital as finance capital in the core states, there is little discussion of the white settler colonies in their work. Bukharin stressed the fetter of landed property on the pace of development of agriculture in the established capitalist formations, but did not link this dis-proportionality to the plight of the suffering classes, or the development of capitalism in white-settler colonies such as New Zealand. For though he mentions directly N.Z.'s role in supplying foodstuffs to the British market, he ignores the significance of cheap wage goods supplied by the semi-colonies in overcoming the land barrier and in countering the falling rate of profit of industrial capital (Imperialism, 19-21).

The most influential theorist of imperialism, Lenin, conceived of imperialism as a distinct (the "highest") stage of capitalism characterised by the concentration of capital in monopolies and cartels in the European states, the export of surplus-capital in search of super-profits, and the increasing rivalry between European states for colonial territories (Imperialism, 700). He also drew a direct connection between imperialism and the reformism of the European working-class which was 'bribed' by colonial super-profits and drafted in defence of national capitals (712). Lenin fully understood the degree to which the contradictions of the CMP were expressed in imperialism; on the one hand, the export of capital “greatly accelerates the development of capitalism in those countries to which it is exported. . . .expanding and deepening the further development of capitalism throughout the world” (691) while on the other hand, the concentration of capital in monopolies established monopoly prices as a barrier to competition, to increasing the rate of relative surplus-value and hence the further development of the productive forces at the centre. The stagnation at the centre therefore intensified the scramble for colonial super-profits based on the extraction of absolute surplus-value at low organic composition (and low wages) (Mandel, MET, 455-458), leading to growing national rivalry and eventually war.

Like Marx and Engels, the weakness in Lenin's theory of imperialism is the element of wishful thinking. Because he believed (rightly as it happened) that the fate of the Russian Revolution would hinge on the revolution in Europe, he exaggerated the ripeness of capitalism's decay and the revolutionary potential of the working-class. Just as important for our discussion, however, was his failure to appreciate the extent and depth of capitalist development in the white-settler colonies. As Barratt-Brown points out Lenin did not distinguish between ‘colonies’ in general and the ‘self-governing colonies of the British Empire’ in his analysis of capital export (Economics, 186). Had he done so he would have seen that the vast export of British capital to the self-governing colonies and Latin America after 1870 was not in search of super-profits but a secure return from the national debts of a number of white-settler colonies established in the period before 1870.

The bulk of British investment was not associated with capitalism's ‘highest stage’ as conceived by Lenin, but with en earlier one, when various class fractions thrown out by the process of accumulation at the centre were relocated in the periphery under changed conditions. There they did lead, it is true, to the consolidation of the (Mp and its development to a higher stage, but only after certain pre-conditions had been satisfied. In sum, the establishment of the CMP in the white-settler states before 1850 and their subsequent development by British finance capital, contributed not only to the success of British free trade policy, but also to her continued supremacy after 1870 in the age of imperial rivalry.

If we allow for the elements of wishful thinking, Marx, Engels and Lenin have left us a theory of imperialism that can be used, together with the interlocking circuit model of the internationalisation process, to analyse the development of capitalism in New Zealand. The changing patterns of world imperialism over this whole period have produced several shifts in the New Zealand state’ s relations with imperial powers, in particular from that of self-governing colony within the British Empire to that of ‘junior partner’ in U.S. imperialism today. But whatever the nature and form of this changing relationship, it has been determined historically by the particular interlocks established with N.Z. by the internationalisation of capital. It is to the actual problem of explaining the historical evolution of the N.Z. social formation (in the light of these combined processes) that we turn in the next section (3). Before doing so however, for the sake of clarity in this analysis we must set-out the basic characteristics of the pre-capitalist modes of production which articulate with the CMP in the N.Z. social formation.

2.7 General Characteristics of the Subordinate modes

We stated in the Introduction (1.1.) that the contemporary N.Z. social formation could only be understood in terms of an articulation of various modes of production. These are the CMP in New Zealand (the development of which is the object of this analysis), together with the residual elements of the pre-capitalist Maori Lineage Mode of Production, and a highly evolved and differentiated Peasant Family Mode of Production. Since the development of capitalism in N.Z. is viewed as the process of articulation of the CMP with these two subordinate modes, we need to define the main characteristics of each of these modes before proceeding further.

(a) The Peasant Family Mode (PFM). The mode we refer to here, is a particular form of pre-capitalist simple commodity production established by the “mass of fanning colonists” in the colonies proper (Marx TSV, V2, 301). Traditionally, the characteristics of this mode are: a patriarchal household and plot of land; production of means of subsistence for use, but with some exchange); and its non-capitalist calculation of ‘profit’ – “. . .so long as the price of the product covers (his) wages, (the peasant) will cultivate his land, and often at wages down to the physical minimum" (Capital, V Ill, 805-806). Whilst these features did, to a degree characterise early N.Z. settlement, the contemporary PFM is quite different in almost every respect, retaining only the family form of labour as a traditional social relation. Unencumbered by any feudal rode and benefitting from cheap and abundant land alienated from the MLM, the PFM in New Zealand has undergone remarkable evolution (see 3.4). (Note: the PFM does not apply to sheep farming).

The evolution and subsequent differentiation of the PFM followed its rapid subordination to the CMP. Thus in N.Z. it came under the firm dominance of the agents of the CMP (e.g. the stock and station agents) who ultimately controlled the family farmer as a sort of wage-slave, despite the position of the farmer appearing to be one of ‘independence’. His independence becomes a ‘formal’ independence; against the fact that he possesses and legally ‘owns’ his land he does not control it (Banaji, Modes, 33-36). The ‘price’ the farmer gets for his product is in fact a ‘concealed wage’ and the interest and commissions paid to the merchant-banker is ‘rent and profit’ (34).

Having determined the underlying nature of the relations of production dominating the PFM as capitalist, we must also point to the manner in which its articulation with the CMP has evolved. In particular, we describe in Section 3.4 how the peasant farmer class used the state as an ally against the merchant-banker class to boost their price and rate of profit. We point to the crucial role of agricultural exports in the 1970's in the efficient reproduction of the CMP in N.Z. (Section 3.5). This historical process has resulted in a considerable differentiation of the PFM, particularly when viewed from the level of distribution (income, profits etc). First, there is the section of quasi-subsistence farmers (e.g. on marginal land); second, there is the middle-peasantry, who in good years might realise an average rate of profit, but because of high levels of debt and fluctuations in their terms of trade, seldom in fact do so; third, there is the peasant bourgeoisie (capitalist farmers), who for some reason or other, could accumulate on the basis of earning an average or above average rate of profit, employing wage-labour, managers, accountants etc. We find, therefore, despite Marx's reference to this form of production as “capitalist. . . without its advantages” (TSV, Ill, 487), (that is, unable to expand reproduction on the basis of the production of relative surplus-value) in N.Z., the interaction of the state, the merchant-bankers, and the natural environment, combined to permit the PFM to evolve out of colonial simple commodity production to provide the basis for expanded capitalist production in the semi-colony (See Lenin, Russia, 175-190).

(b) The Maori Lineage Mode (MLM). The mode of production which corresponds to the ‘structure’ of the Maori social formation is that of ‘primitive communism’, or the ‘lineage mode’ (Terray, MPS; Hindess and Hirst, PCMP). Notwithstanding the debates surrounding this concept, for the moment we adopt the view that the basic characteristics of the Lineage Mode apply to Maori society - they are; a low level of development of the forces of production, community ownership and possession of the means of production, cooperative labour and collective distribution of the product at the economic base; the absence of a state and the dominance of ideology in the form of kinship relations at the level of the superstructure - hence the term ‘lineage’ signifying the key role of ideology in reproducing the conditions of existence of this mode.

The MLM can therefore be characterised in these terms as having an economic base comprising collective ownership and control of the means of production, and where the distribution of the product is not determined by class relations at the base, but is dominated by the ideological agents (elders, chiefs) who (a) do not form a ruling class, (b) do not therefore require a state, but (c) are responsible to the collectivity for the reproduction of the mode. In short, the MLM is a good example of Marx’s concept of primitive communism (Grundrisse, 471-474).

The historical process by means of which the MLM became subordinated to the CMP has been described by us elsewhere (Bedggood and De Decker, Destruction; Macrae, The Maori). It follows approximately the same stages suggested by Dupre and Rey (Reflections) beginning with:

(a) Trade: The period from European contact to about 1860 during which the main links with the MLM were via traders and missionaries. The MLM quickly adapted to the commodity market and withstood early attempts at domination by agents of the CMP to a high degree.

(b) The Colonising Period: from 1860-1880 approx. during which state force was used to break the resistance of the MLM to the penetration of the CMP resulting in widespread alienation of the land, the pre-condition for the transformation of collective labour into capitalist wage-labour, and the establishment of the PFM.

(c) The Period of CMP dominance: From approx. 1880-1945. The MLM was reduced to a semi-subsistence peripheral mode providing labour at low wages in seasonal or casual work in the CMP, now consolidating its hold over the PFM and laying the basis for domestic manufacturing on the post-war 11 scale.

(d) Industrial Proletariat Stage: From 1945 to the present, during which the bulk of the rural population of the MLM migrated to the cities to join the industrial proletariat. Today, approx. 1.3 million hectares of Maori land remain in areas of strategic importance for forestry, iron sands, urban development etc. This fact, together with the rising level of proletarian consciousness among Maori workers, shows that while the MUM has been almost totally subordinated to the CMP, the residual elements of its base (the land and cooperative social relations) and of the superstructure (ideology and ‘culture’') play a significant role in the current conjuncture (see 3.7).

------------------------------------------------------------------

No comments:

Post a Comment